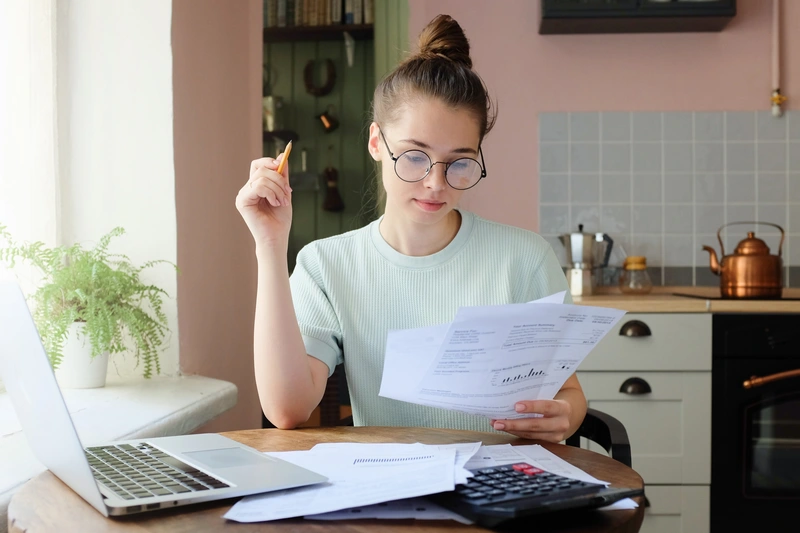

Investing in Ontario’s student rental market can be a profitable venture, but it requires careful planning and research. Below are eight essential steps to help you make a well-informed investment and get started as a student rental landlord. Look below if you are considering investing in Student Rentals in Ontario:

1. Research Local Rental Rates

Start by searching for rental listings near your target university or college. Type “[University/College Name] + off-campus housing” into Google to find dedicated listing sites, which many institutions provide. Although you may need to pay for a listing, these platforms ensure direct access to your target market.

To get a realistic sense of rent prices, compare at least ten listings in your desired area. Look for details on what’s included in each rental, such as utilities and internet. For example, some properties may charge $600 per room without utilities, while others may include utilities for $700. Taking an average of these rates will help you set a competitive price for your rental.

2. Find Average Property Prices

Use Realtor.ca or similar sites to explore property prices in your chosen area. Properties listed below the average price may need repairs or upgrades to meet student housing standards, so factor in these potential costs. Updating older utilities, such as plumbing or electrical systems, can also impact insurance premiums, so keep this in mind as you evaluate properties.

3. Create a Detailed Financial Projection

To understand your potential income and expenses, it’s essential to get comfortable with a spreadsheet tool like Excel. Start by estimating the rent for each room; larger or main-floor rooms may command higher prices than basement or smaller rooms. Calculate the total projected revenue, then list out your monthly expenses, including:

- Mortgage payments

- Property taxes

- Student rental house insurance

- Utilities (water, hydro, gas)

- Maintenance costs

- Buffer for unexpected expenses

Sample Financial Breakdown:

| Category | Details |

|---|---|

| Purchase Price | |

| Down Payment | |

| Amortization | |

| Interest Rate | |

| Monthly Mortgage | |

| Start-Up Costs | Down payment, inspection, appraisal, land transfer tax, legal fees, renovations, buffer |

| Revenue (monthly) | Sum of all room rents |

| Monthly Expenses | Mortgage, property tax, insurance, utilities, maintenance, etc. |

Calculate both monthly and annual income, keeping in mind the potential for vacancy or unexpected repairs.

4. View Properties and Conduct Inspections

With a clear budget in mind, begin visiting properties that fit your criteria. Once you find a suitable investment, schedule a home inspection. This step is essential to uncover any needed repairs, particularly for important utilities like electrical and heating systems. Required updates could give you leverage during price negotiations, so be prepared to work with licensed contractors to address these issues.

5. Understand Legal and Zoning Requirements

Each city or municipality may have specific zoning requirements, bylaws, and licensing rules for student rental properties. Check with the local government to ensure your property is legally compliant as a student rental. This might include obtaining rental permits, adhering to occupancy limits, or making property adjustments, like adding safety features (fire alarms, emergency exits) to meet local codes. Compliance not only prevents legal issues but can also impact your insurance eligibility.

6. Plan for Seasonal Maintenance and Upkeep

Student rental properties often experience higher turnover and wear-and-tear, so it’s essential to budget for seasonal maintenance. Establish a maintenance routine to keep the property in top shape and address issues like plumbing leaks, heating or cooling maintenance, and general upkeep. This proactive approach will not only help retain tenants but also demonstrate that your property is well-managed, potentially lowering risks and insurance costs.

7. Importance of Proper Rental Property Insurance Coverage

Investing in student rental house insurance tailored to student properties protects you from unique risks, such as higher turnover, potential property damage, and liability issues if a tenant or guest is injured. Comprehensive coverage can help you manage unexpected events and minimize out-of-pocket expenses, ensuring your investment is secure.

8. Tip on Tenant Screening

One of the key factors for success in the student rental market is choosing reliable tenants. Consider implementing a thorough screening process, including reference checks from previous landlords or guarantors. Screening tenants properly can help reduce the risk of property damage and unpaid rent, allowing for a smoother rental experience.

Final Thoughts on Maximizing Your ROI

Staying involved in the property and building a good rapport with tenants can lead to fewer issues and better tenant retention. Happy tenants are more likely to renew leases and care for the property, increasing your returns. Plus, addressing any concerns quickly and efficiently sets the property up for long-term success.

Enjoyed this Article?

Please like and share on Facebook to spread the word!

See Related Articles

- Hamilton Rental Property Licensing: What Landlords Need to Know

Discover the licensing requirements for rental properties in Hamilton, including details on application processes, inspections, and compliance to keep your rental property up to standard. - More Cities Regulating Rental Housing & Student Rentals

Learn about the trend of increased rental housing regulations across Ontario, including implications for student rental properties and what landlords should expect. - Why Investing in Ontario Student Rental Properties Might Be a Good Investment

Find out why student rentals are an attractive investment opportunity in Ontario, with insights into market demand, location advantages, and potential financial returns. - What to Look for When Buying a Student Rental to Keep Insurance Costs Down

Explore key considerations for purchasing a student rental property, focusing on features and updates that help minimize insurance premiums and enhance property safety.

August 7, 2024

August 7, 2024 5 min

5 min