Brampton Car Insurance

For more than thirty years, Humberview Insurance Brokers has been diligently serving clients

in Brampton,, providing residents with tailored Brampton car insurance solutions. We know the challenges

you face, and our mission goes beyond offering affordable rates. Our team of seasoned, licensed

Insurance Brokers is here to guide you to the ideal policy, dispensing advice and robust support.

Our commitment to serving your Brampton car insurance needs is unwavering, beginning the moment you

reach out for a quote and enduring throughout your entire experience with us.

Standard Car Insurance in Brampton, Ontario

Liability

Liability portion of your car insurance policy provides protection against damage you cause to other people or their property

Direct Compensation Property Damage

Covers damage to your vehicle from your own insurance company to the extent you are not at fault. (For portion you are at-fault you would need collision or all perils coverage). As of January 1 2024, there is an option to opt out of this coverage.

Uninsured Automobile Coverage

Protects you if you are hit by an uninsured motorist or by a hit and run driver. This portion will cover damage to your automobile caused by an identified uninsured motorist.

Accident Benefits

Provides compensation if you or others are hurt or killed in a car accident.

Extra Coverages for your Brampton Car Insurance to Take You Those Extra Km’s

Collision Coverage

Covers your damage to your car as a result of hitting an object or another car

Comprehensive Coverage

Covers some insured damages such as falling objects, theft and fire.

All Perils Coverage

Most extensive physical coverage for your car. Covers collision + comprehensive and better theft coverage.

Accident Forgiveness Coverage

Most extensive physical coverage for your car. Covers collision + comprehensive and better theft coverage.

Depreciation Waiver Coverage

Gives you the purchase price of the vehicle in the event of a total loss.

Rental Vehicle Coverage

Provides you with a rental vehicle to a specified limit after an insured loss.

How Brampton Car Insurance Rates Determined

Brampton car insurance rates are determined by several key factors, including the car you drive, your driving habits, and where you live. Vehicles with larger engines, higher values, or lower safety ratings often result in higher premiums. If you drive long distances or commute daily, your rates may be higher compared to someone who only drives occasionally. Your driver profile—including age, driving history, past tickets, and accidents—also plays a crucial role in pricing. The coverage options you choose, from comprehensive to collision insurance, can impact costs, while qualifying for discounts like multi-vehicle policies or safe driving can help lower your premium. Our brokers can assist you in selecting the right coverage for your needs.

Ways you Can Save to Get Cheap Brampton Car Insurance

Bundle

Add your house policy to get a multi-line discount..

Insure two or more vehicles

Insuring your vehicles with the same company can result in you receiving a multi-vehicle discount for all vehicles on the policy.

Shop Around

In Ontario, there are many options for car insurance whether through agents, brokers or direct companies. There are many offerings.

Increase deductibles

Determine how much you are comfortable covering yourself if minor damage occurs and adjust your deductible accordingly.

Pay Yearly

Some insurers charge a maximum rate of 1.3% for paying for your car insurance on a monthly basis. If your company is charging you for paying monthly – ask about paying annually or in larger installments to avoid fees.

Install winter tires

Installing winter tires on your vehicles just makes sense for winter driving, but it can also save you money on what you pay for your car insurance.

Take a Drivers Training course

If you are a young or inexperienced driver the price you pay for car insurance might be improved by taking an approved driver training course.

Consider Renewing

Insurers typically give renewal discounts after a year or three and it might be wise to consider what the renewal price will be when you are shopping around.

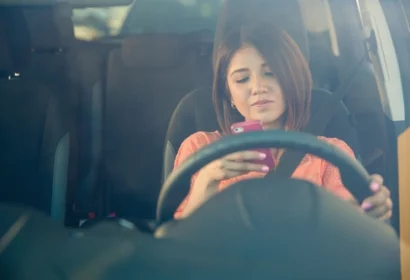

Real Tips for Driving In Brampton

Securing Brampton car insurance can be pricey, but savvy driving and some strategic know-how can streamline the process and even cut down costs. Here are tailored tips for traversing the bustling roads of Brampton.

Stay Alert for Pedestrians

Brampton's streets are busy, with pedestrians often crossing busy intersections. Stay vigilant, especially in school zones and residential areas, to ensure safety for all.

Equip Winter Tires

Brampton's winters demand reliable winter tires for safer navigation during icy and snowy months. Not only is this a key safety practice, but many Brampton car insurance companies also offer discounts for vehicles equipped with winter tires

Check Brampton Weather

With weather conditions that can turn on a dime, it's wise to check the forecast before any trip. Adapting your driving to current weather conditions is crucial to prevent accidents and maintain a spotless driving record.

Mind the Heavy Traffic

Brampton is known for its heavy traffic, especially during peak hours. Plan your routes ahead of time to avoid congested areas and consider alternative timings to dodge the worst of the traffic jams.

Fog and Frost Advisory

During fall and winter, early morning fog and frost can reduce visibility and road traction. Adjust your speed accordingly and maintain a safe following distance to avoid collisions.

Why Humberview?

-

You Get One Dedicated Broker

We are not a call center, you will have the same broker for your policy.

-

In Business Since 1982

We are an independent broker located in Toronto since 1982

-

Quotes from Top Insurers

We represent some of Canada's best insurance companies.

-

No phone prompts when you call us

Speak to a human, right away.

Brampton Car Insurance by Vehicle

Did you Know About Brampton?

Brampton, a dynamic city within the Greater Toronto Area, is home to a tapestry of neighborhoods, each with its own character and appeal. As Brampton continues to flourish, its communities grow, making Brampton car insurance a vital component for its residents. Here's a glimpse into some of Brampton's neighborhoods

Downtown Brampton (City Centre) - L6Y

The bustling heart of the city, Downtown Brampton is alive with shops, eateries, and a rich array of festivities. It's a place where commerce, history, and leisure coalesce.

Springdale - L6R

Springdale boasts a variety of housing developments and is dotted with parks and schools, making it ideal for families.

Mount Pleasant - L7A

Celebrated for its community vibe, Mount Pleasant is a transit friendly area with village-like charm, green spaces, and modern amenities.

Heart Lake - L6Z

A scenic locale named after the heart-shaped lake at its center, this neighborhood is perfect for nature lovers and active families.

Castlemore - L6P

Castlemore is synonymous with sprawling estates and luxurious homes, appealing to those seeking a quieter suburban feel with upscale living.

Bramalea - L6T

One of the oldest and most extensive neighborhoods, Bramalea is characterized by its distinct sections, each named with a 'B' and a varied selection of home styles.

Fletcher's Meadow - L7A

A rapidly growing family-oriented area, Fletcher's Meadow features newer homes and excellent schools.

Fletcher's Creek South - L6X

This community is rich in green spaces and close to amenities, with diverse housing that appeals to a broad demographic.

Vales of Castlemore - L6P

An affluent area with stately homes and manicured lawns, offering a quiet residential atmosphere.

Gore Industrial South - L6T

This industrial hub is vital to Brampton's economy, with numerous businesses and warehouses

High-traffic streets and intersections in Brampton include

Queen Street and Highway 410

As a central thoroughfare, this area can be particularly busy, serving as a gateway to the rest of the GTA.

Steeles Avenue

A major east-west corridor that's often bustling with traffic due to its commercial zones and access to public transit.

Bovaird Drive

This arterial road cuts across Brampton and sees significant traffic flow, connecting residents to both shopping and services.

Chinguacousy Road

This road is frequently traveled by those visiting the Brampton Civic Hospital or the bustling Brampton City Centre.

Airport Road

Serving as a crucial link to the Pearson International Airport and industrial sectors, it's a hive of activity most times of the day.

Understanding the various neighborhoods and traffic patterns is key when considering Brampton car insurance, ensuring you have the right coverage for your lifestyle and driving needs in this vibrant city

Brampton Car Insurance FAQ

-

How much car insurance do I need in Brampton, Ontario?

In Brampton, you'll need the standard Ontario car insurance coverages: Third-Party Liability, Statutory Accident Benefits, Uninsured Automobile, and Direct Compensation-Property Damage. The city's bustling traffic. Discussing with a Brampton car insurance broker can help you determine the right coverage levels for your needs. -

How much is car insurance per month in Brampton, Ontario?

Brampton car insurance rates can vary based on factors like your driving history, vehicle type, and chosen coverage. While Ontario drivers may pay between $200 to $350 monthly, Brampton's rates can be higher due to its proximity to Toronto. For the most accurate estimate, get quotes from multiple insurers, and consider discounts for clean driving records or bundling policies -

How much is insurance for a G2 Driver in Brampton, Ontario?

Insurance for G2 drivers in Brampton can be costly, reflecting the increased risk of less experienced faq drivers. Rates can range from $1,800 to over $5,000 annually, influenced by age, driving history, and vehicle type. To potentially lower costs, G2 drivers can take a driver's training course or be added as occasional drivers on a parent's policy. -

Which car has the cheapest insurance in Brampton, Ontario?

In Brampton, cars with lower insurance rates include economy sedans, vehicles with good safety ratings, models with lower theft rates, and used cars. Popular choices for cost-effective insurance might be the Toyota Corolla or Honda Civic. Rates are personalized, so consider your driving history and vehicle usage when evaluating Brampton car insurance options. -

How much is car insurance in Brampton, Ontario for a new driver?

New drivers in Brampton face higher insurance costs, typically starting around $300 to $500 monthly. These rates can vary greatly depending on vehicle type and driving history. New residents with a driving record from abroad or another province should provide a "letter of experience" to potentially receive credit and lower rates. -

Do all drivers in a household have to be insured in Brampton, Ontario?

In Brampton, as in all of Ontario, all licensed drivers in a household are generally expected to be listed on the car insurance policy. If not, it could result in policy cancellation for non-disclosure

Brampton Car Insurance Quotes For Different Types of Car Insurance

Clean Record Car Insurance in Brampton

- In Brampton, drivers with impeccable records are rewarded with the most competitive Brampton car insurance rates.

- Humberview Insurance Brokers is committed to providing affordable car insurance solutions that cater to the specific needs of the Brampton community.

- Our experienced, licensed Insurance Brokers are on hand to help you find the right policy and offer expert advice, especially when it comes to managing claims.

Brampton Commercial Auto Insurance

- Humberview Insurance Brokers has established itself as a go-to source for Commercial Auto Insurance in Brampton for over thirty years.

- Whether you're a contractor, a cafe owner, or use your vehicle for any business purpose, our goal is to support your commercial activities.

- We tailor policies to ensure your business and assets are well- protected, making us a dependable choice for your commercial auto insurance needs in Brampton.

Brampton High Risk Car Insurance

- Some drivers in Brampton may require high-risk car insurance due to a history of driving infractions, such as impaired driving, which carries severe risks and legal consequences.

- Other reasons for needing high-risk insurance could be multiple traffic offenses, at-fault accidents, or insurance coverage gaps.

- Our high-risk insurance options provide a path for drivers to improve their driving records while staying fully insured on the busy roads of Brampton.